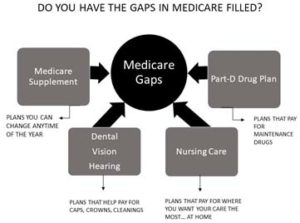

Medicare might be the best healthcare program anywhere, but there are gaps. It does not cover everything. This is where a Medicare Supplement (Medigap) plan comes into play, covering some of the costs not covered by Medicare Part A and Medicare Part B. These out-of-pocket costs include areas like copays, coinsurance, and deductibles.

Now to purchase a Medicare supplement, you must be enrolled in Medicare Part A and Medicare Part B. And the best and most common time to enroll is when an individual turns 65. Once enrolled you have up to six months to purchase supplemental coverage where your acceptance is guaranteed. Once those six months are up, your application will have to go through underwriting, where a company may not cover you due to certain health conditions. You will have a premium for your Medicare Supplement (Medigap) plan, which can be paid monthly, quarterly, semi-annually, or annually. You will also have a monthly premium you pay to Medicare for your Part B.

A regular Medicare Supplement (Medigap) plan with a letter attached to it is standardized. This means that no matter the company you choose, the coverage for the letter you choose will be the same. This also depends on the state you live in because there are a few states that have the supplemental coverage standardized in a different way.

But be aware, just because the coverage is the same does not mean the price is the same. Premiums will also start to vary as you get older. So, it is important to compare plans to make sure your choice fits into your budget. And as long as you continue to pay the premiums, your plan will be renewed, and your coverage will continue.

Enrolling in Original Medicare (Part A and Part B) and applying for a Medicare Supplement (Medigap) plan requires you to get a separate policy to cover your prescription drug coverage.

A Medicare Supplement (Medigap) plan is different than a Medicare Advantage plan. Having a Medicare Advantage plan means that you have not enrolled in Original Medicare (Part A and Part B) but have enrolled in what is commonly known as Medicare Part C. These plans are all-in-one and can even include your prescription drug plan all for a low or no monthly premium. You will still need to pay your monthly Part B premium.

We work with all types of supplemental coverage. There are pros and cons to each of the options available to you. And our representatives are happy to explain and compare all your options. We want to help you get the benefits you want and deserve.

Reach out to our office or your representative to learn about how plans covering these areas are beneficial to you.

Medicare Premiums for 2024

- Most people get Part A automatically when they turn age 65. They do not have to pay a monthly payment called a premium for Part A because they or a spouse paid Medicare taxes while they were working.

Medicare Deductible and Coinsurance Amounts for 2024:

Part A: (pays for inpatient hospital, skilled nursing facility, and some home health care) For each benefit period Medicare pays all covered costs except the Medicare Part A deductible (2024=$1,632) during the first 60 days and coinsurance amounts for hospital stays that last beyond 60 days and no more than 150 days.

For each benefit period you pay:

- $0 for the first 60 days of each benefit period after the $1,632 deductible is met.

- $408.00 a day for the 61st – 90th day each benefit period.

- $816.00 a day for the 91st – 150th day for each lifetime reserve day (total of 60 lifetime reserve days – non-renewable).

- All costs for each day after day 150 of the benefit period.

Skilled Nursing Facility Coinsurance

- 3-day inpatient hospital stay required first.

- $0 for the first 20 days of each benefit period.

- Up to $204 a day for the 21st – 100th day each benefit period.

Part B: Covers Medicare eligible physician services, outpatient hospital services, certain home health services, durable medical equipment.

Above information from Medicare.gov January, 2024